Apply now and get RM50 Cashback Voucher!

The Starter Pack Insurance Fund (SPIF) program is an initiative by the Life Insurance Association of Malaysia to establish a RM5 million fund to encourage youth and young families to purchase life insurance. It is also aimed at encouraging first time buyers of life insurance protection. Details of the SPIF programme is posted on the LIAM website at www.liam.org.my. *The RM50 cashback voucher is valid until the RM5 million has been fully redeemed.

Why Us?

Up to RM60,000 coverage for RM1.88 for first month (RM45 for subsequent months)

Covers 45 critical illness

Payout for personal accident

Same premium rate for all ages

Protection until 65 years next birthday

Flexible cash withdrawal

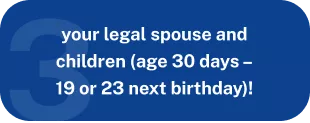

You are eligible if you are...

Apply for

| Coverage provided under this scheme | |

|---|---|

| Benefits | Sum Assured |

| Premium of RM45/month | |

| 45 Critical Illnesses* | RM30,000 |

| Death (due to illness or Natural Cause) | RM30,000 |

| Accidental Death | RM60,000 |

| Total and Permanent Disability (TPD) (due to illness) | RM30,000 |

| Total and Permanent Disability (TPD) (due to Accident) | RM60,000 |

| Daily Hospitalisation Income Benefit | RM30/day |

| Funeral Expenses | RM5,000 |

| Total Investment Value (TIV) | Based on Net Asset Value (NAV) |

RM1.88 first month premium + RM50 casback Promotion

Terms and conditions:

- This insurance plan is eligible for the Starter Pack Insurance Fund (SPIF) program. SPIF is an initiative by the Life Insurance Association of Malaysia to establish a RM5 million fund to encourage youth and young families to purchase life insurance. It is also aimed at encouraging first time buyers of life insurance protection. Details of the SPIF programme is posted on the LIAM website at www.liam.org.my.

- *The RM50 cashback voucher is valid until the RM5 million has been fully redeemed.

- RM50 Touch ‘n Go eWallet Reload Pin will be sent to your email address within 60 days after your policy is in-forced.

- Eligible customers must successfully make their 1st month (RM1.88) and 2nd month premium payment (original premium of RM45 or RM30 per month) via the online application form in order to receive cashback per application

- Customers can purchase this plan at RM1.88 for the first month and the original premium for subsequent months.

- Partial cash withdrawal for emergency by redemption of units after contributing for at least 12 months.

- The policy certificate will be sent to the customer’s email address within 21 working days once the policy is accepted. No Assurance in respect of any Life Assured shall take effect under this Policy, unless notification has been duly made and the Company has intimated acceptance of the risk in writing.

- The Intermediary Commission for this product amounts to a maximum of 10% of premium charges while the Service Fee amounts to 2% of premium charges.

- Free-look period – you may terminate the plan by returning the Certificate of Assurance to the Company by hand or registered post within fifteen (15) days after your receipt of the same. If the plan is terminated during this period, the Company shall refund an amount equal to the sum of, total investment values of the Certificate of Assurance, the investment values of the units which have been cancelled to pay for insurance charges and policy fees based on Net Asset Value at the Next Valuation Date, and the amount of premiums that have not been allocated to purchase units; minus the expenses incurred for medical examination, if any.

- Terms and conditions apply.

- For further information about the product, please reach out to: gmbismarketing@greateasternlife.com

Great Eastern Life Assurance (Malaysia) Berhad Life Insurance Complaint Handling: feedback@greateasternlife.com